On November 8th, 2016, Government of India announced its decision to demonetize or ban old currency notes of INR 500 and INR 1,000 in circulation. This move was taken to curb “black money and counterfeit notes used by terrorist organizations for illegitimate activities” in the economy. These two currency notes account for 86% of all the currency in circulation.

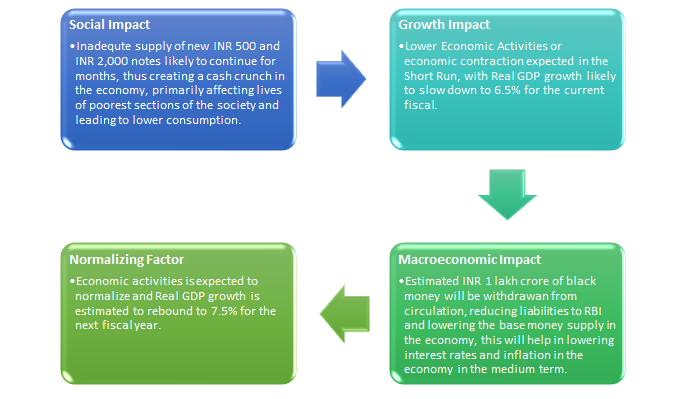

The move to demonetize High Denomination Currency notes has massively impacted lives of almost every Indian according to the market info. This has also hampered the economic activities around the country. A recent report from Deutsche Bank estimates that Indian real GDP growth is likely to slow down to 6.5% in the current fiscal year due to demonetization. Major implications of this demonetization are mentioned below:

Cash-less Economy

India is predominantly a “cash-based” economy, with 98% of all consumer transactions conducted in cash, in terms of volume, and over 85% of workers receiving their wages in cash. This move is also expected to propagate the notion of “Digital India” mission undertaken by government to make transition smoother from a cash-based economy to a “cash-less” economy.

Increasing Tax Revenue

In addition, India is essentially a very poor nation in international standards with annual per capita GDP of below US$1,600 in 2015, as data from World Bank suggests. By forcing people with illegal cash holdings to deposit such cash holdingsinto bank accounts and pay taxes is intended to increase tax revenue to the government. These tax revenues can then be utilized to finance better public infrastructure as well as other social welfare programs for the poorest sections of the society.

Effectiveness of the Move

Former RBI Governor, Raghuram Rajan, had pointed out during a conference in 2014 that demonetization has limited positive effects. He also mentioned that it would be helpful for the Indian economy to have a better tax regime to achieve positive long run sustainable effects.

For its direct implications, this decision by the Indian government is intended to curb out the black money in circulation. This will only affect unaccounted cash that is held in cash. That is, it will not have any impact on the black money that is held in the form of assets such as gold or property, and foreign currency denominations. In addition, this will have minimal effect on lowering the corruption or to increase the tax revenue in the long run.

Conclusion

This demonization program is expected to help government to tackle black money and counterfeited currency notes in the economy, but only to some degree according to market research. This program is expected to bring positive impact for the Indian economy, including lowering interest rates, lowering inflation in the medium run, and higher taxation revenue in the short run, and reduced tax burden. However, the Indian government will need to work on several other transparent policies and a better tax system to achieve its goals of rooting out black money and eventually the parallel economy.