The word ‘Unicorn’ is a word coined with those successful start-ups. The “unicorn” was primarily a concept among U.S. companies in the beginning. In summary, Unicorn is for describing a start-up with a valuation of over $1 billion. The unicorn was first coined by venture capitalist Aileen Lee in 2013. Today, it spans across the globe identifying new unicorns rising through the ranks each year in different geographies. Globally, the last two decades have witnessed the start-up boom, and flow of capital into new ventures. Thus, this is the natural outcome of identifying Leaders from the rest in the start-up world.

In the Start-up sphere, the ultimate mark of success is entry into the ‘unicorn club of late. Thus, all start-ups initiate their business plan with a focus to reach the Unicorn in ‘x’s years. However, for start-ups that have successfully raised funding, the prospect of reaching these lofty heights is smaller than 1%. It can be seen from the following market intelligence. As of June 2021, there are more than 700 unicorns around the world. These tech start-ups are collectively worth over $2T and believe to have raised a combined capital of $426B. Thus, it shows approximately 1% of start-ups reach the unicorn status.

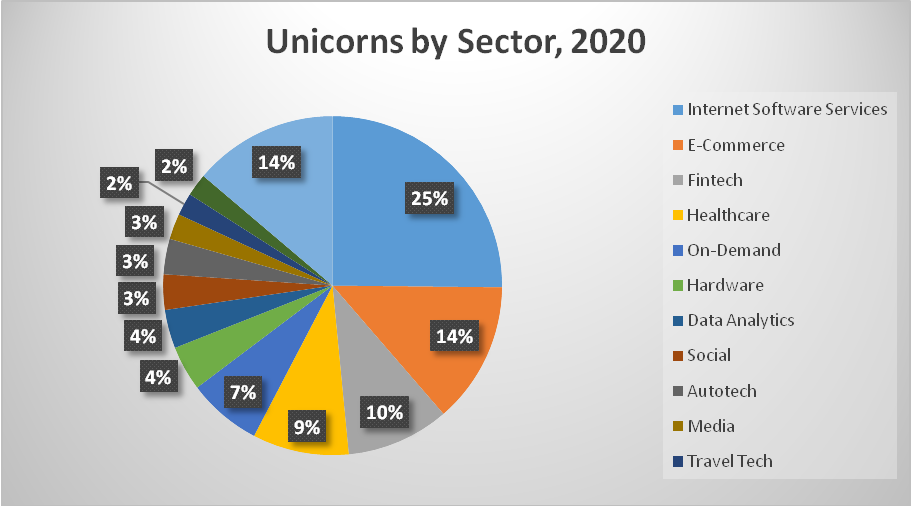

The types of a start-up which reach the Unicorn club keep on changing every year. There are multiple factors associated with it, and mostly technology and market acceptance are the major factors. In 2021, the patterns of Unicorns are moving more toward the Fintech sector. The uniqueness of Fintech is that it encompasses nearly all new technology that seeks to improve and automate the delivery and use of financial services. It leads the herd with 15% of unicorns existing in this space. It is followed by eCommerce and marketplace. At 13%, start-ups in the eCommerce and marketplace industries closely follow Fintech.

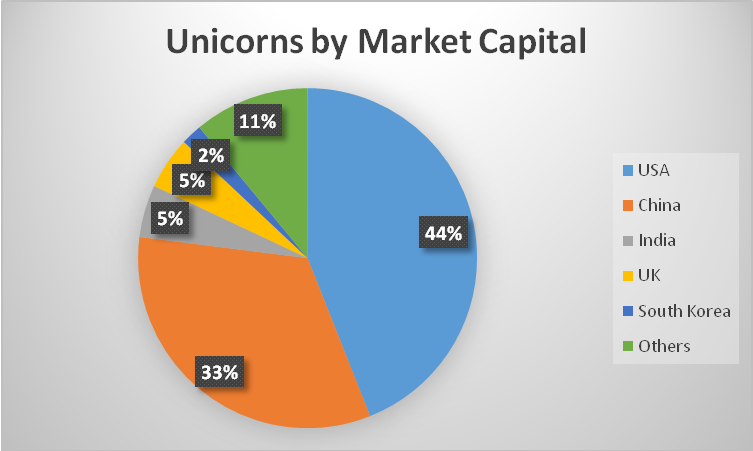

The majority of unicorn start-ups were found in the USA, and about 44% of unicorns were found there. The USA and China top the list with 77% of the market capitalization in the unicorn market. The details are depicted in the pie chart.

In the USA, Internet software and services are the foremost common sector for unicorns, with 19% of the country’s unicorns working within this sector. In China E-Commerce start-ups command the prime share of the market at 22%, internet software and services sit at just 9%. This is unsurprising given that majority of all global eCommerce now happens in China and its digital economy continues to expand.

The UK – Fintech is far and away from the most important sector, with 40% of its 15 unicorns working in finance. The United Kingdom is one of the few places where the amount of banking and payments companies has risen. Since 2005, there are 3x times as many financial businesses in the UK. London has the highest concentrations of financial institutions in the world.

According to market data, 7.1% of the start-ups in the world operate in the Fintech industry, Life sciences, and healthcare with 6.8%, Artificial Intelligence with 5%. The highest-valued private start-up in the world is Bytedance from China with $75 billion. According to Startup Statistics (2021), 60% of entrepreneurs believe that AI is currently the most promising innovative technology

DART Consulting provides business consulting through its network of Independent Consultants. Our services include preparing business plans, market research, and providing business advisory services through the network of Independent Consultants. More details at https://www.dartconsulting.co.in/dart-consultants.html