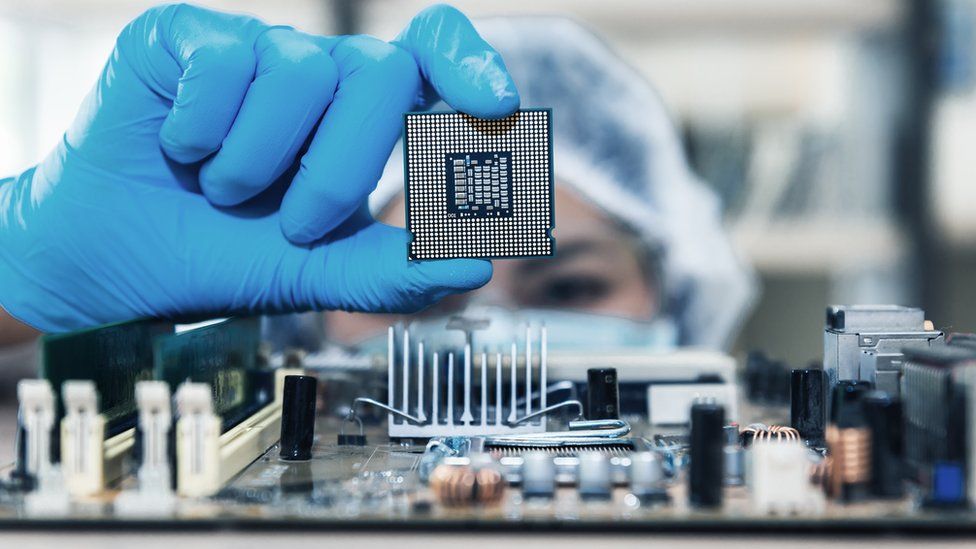

The chip shortage has caused much disturbance among the industries since they struggle to meet the increasing demand of electronic products and components. As of now, the companies are adjusting in their own ways, and most do not expect a resolution any time soon.

The chip scarcity as an industry-wide issue that may not be addressed until at least next year, if not 2023, according to market research data. Chip demand is very strong, and there is no reason to anticipate a sudden oversupply of semiconductors in the coming weeks.

Currently, there are just a few chipmakers across the world, and most of the world’s supply of semiconductors comes from a single firm headquartered in Taiwan: Taiwan Semiconductor Manufacturing (NYSE: TSM) and the country is not stable politically. the United States has requested $37 billion in financing for legislation to boost semiconductor production in the country. Currently, four new plants are planned in the country, two in Arizona by Intel Corp and one by TSMC, and one in Texas by Samsung. China has also provided a slew of subsidies to the semiconductor sector to decrease its reliance on Western technology. However, chip factories cost tens of billions of dollars to build and increasing capacity may take up to a year for testing and certifying complex tools.

In summary, there are numerous reasons for the chip famine, but the fundamental cause is the inability of technocrats and businessmen to do right market research and assessment to meet the demand and supply gap. To meet demand, a significant number of manufacturing units needs to be established, which is a difficult job that requires years of planning and investment. As a result, there is no fast cure to the semiconductor crisis.

Here is an effort to list out the causes of chip scarcity:

- Intel, the world’s biggest producer of x86 CPUs for PCs and data centres, had a chip shortage in 2018 as the company’s problematic development of new 10nm processors affected 14nm chip manufacturing. When Samsung failed again last year by postponing the introduction of its new 7nm chips, it had not addressed the shortfall. Because of Intel’s mistakes, more PC manufacturers purchased AMD’s (NASDAQ: AMD) CPUs, placing a pressure on AMD’s supply. Unlike Intel, which produces its own chips in-house, AMD outsources the majority of its chip manufacturing to Taiwan Semiconductor Manufacturing (NYSE: TSM), the world’s most sophisticated semiconductor foundry. As a consequence, prior to the pandemic, AMD’s growth and market share increases put further strain on TSMC’s facilities.

- Another pressing issue is the tech battle between the United States and China, which accelerated under President Donald Trump and is still ongoing under new President Joe Biden. In response to national security concerns, the United States has already sanctioned many major Chinese firms, including SMIC and Huawei. These sanctions are exacerbating China’s shortage of advanced chips, but they are also encouraging the Chinese government to aggressively invest in domestic chipmakers to reduce its overall reliance on overseas technologies, which could result in a messy decoupling of the US and Chinese markets. China is a significant participant in semiconductor chip, but its production is dependent on advanced chips imported from TSMC and Samsung. The US has implemented sanctions to prevent China from gaining access to these chips, resulting in a production crunch in China. Apart from the sanction at the geopolitical level the Tense situation between China and Taiwan is also a major issue impacting the Semiconductor chips. At the end of the day, semiconductors represent the linchpin for the US and China’s mutually dependent technological ambitions: every major Chinese tech company relies on US chips, and many US firms have benefited from Chinese markets and customers.

- Finally, The Covid-19 epidemic has increased consumer electronics demand. The initial wave included individuals purchasing PCs, monitors, and other equipment to work or attend school remotely. Then, home entertainment devices such as gaming consoles, televisions, cell phones, and tablets began to fly off the shelves. Electronic industry behemoths that have claimed record sales believe they might have been much better if there had been sufficient supply. Apple, which just announced a $111 billion quarter, reportedly warned investors that it did not have enough supply of its new iPhones to satisfy demand.

- This is a typical example of the “bullwhip effect,” in which inventory levels vary unexpectedly in reaction to changes in customer demand farther down the supply chain. additionally, The cost of silicon has increased significantly as a result of the mass manufacturing of COVID-19 vaccinations; the silicon used to produce the vials is the same as that used to make chips and personal computers.

- The shortfall is bringing to light a fundamental shift in the semiconductor industry. Many of the world’s leading semiconductor firms are now “fabless,” which means they only design the chips and the technology that goes into them. Other businesses, called as foundries, are mostly in charge of producing the chips. The foundries are operated by firms like as TSMC in Taiwan and Samsung in South Korea. The automobile sector is given less importance than electronics businesses in the industry. In 2020, automotive chips accounted for just 3% of TSMC’s revenue, compared to 48% for smartphones. This is due to the fact that IT firms are “the volume guys.” They have greater profit margins. Furthermore, they never reduce their orders and have long-term contracts with the foundries.

DART Consulting provides business consulting through its network of Independent Consultants. Our services include preparing business plans, market research, and providing business advisory services. More details at https://www.dartconsulting.co.in/dart-consultants.html